Ethoca Consumer Clarity

Ethoca Consumer Clarity™ provides rich merchant and purchase information to cardholders within their bank apps — and with financial institutions' call center and back-office staff.

Prevent disputes. Improve experience.

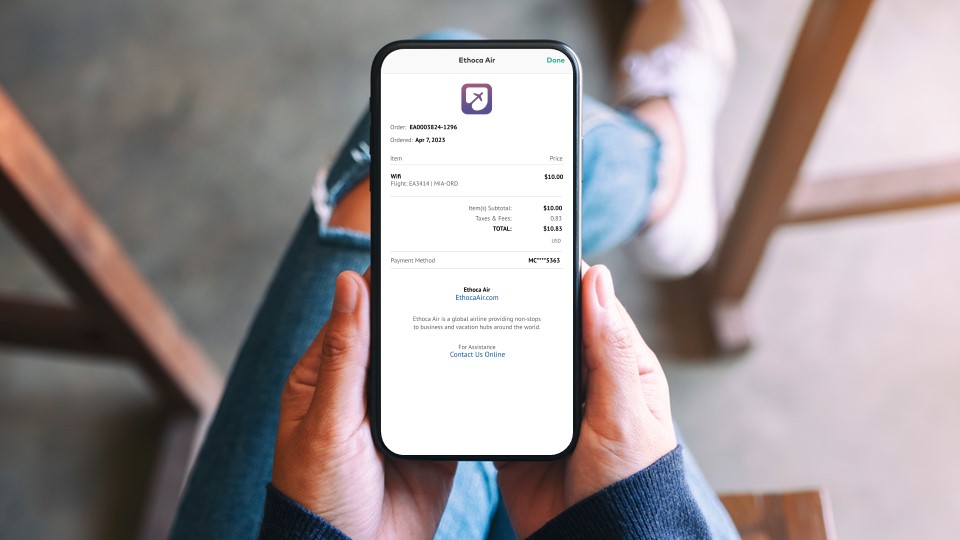

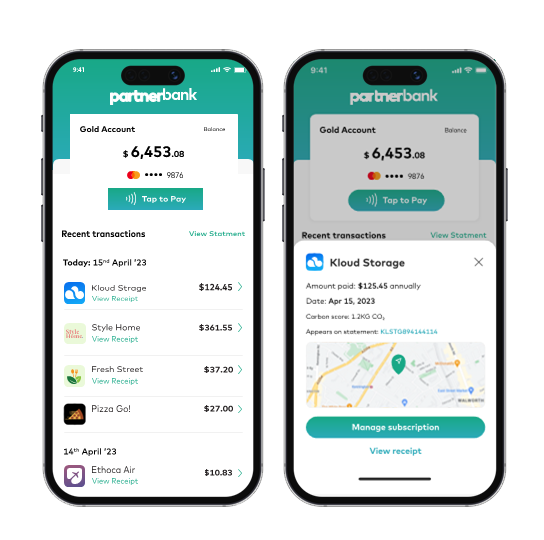

By connecting merchants and issuers together, Consumer Clarity enables rich purchase information sharing – including clear merchant names, logos, geolocation data, fully itemised receipts and even smart subscriptions functionality – to be shared via issuers' digital banking apps and back-office teams. This provides cardholders with multiple channels to get purchase information that helps reduce confusion that often leads to friendly fraud disputes, while also building a better customer experience.

See Consumer Clarity in action

Consumer Clarity makes it easier to share rich purchase information with customers - either directly through their digital bank app or by providing issuer call center staff more detailed information. This includes details like clear merchant names and logos and even itemised digital receipts. Want to see how this works in action? Check out our demo now!

Engage cardholders with Smart Subscriptions.

Smart Subscriptions enables issuers to provide their cardholders more insight and control over their subscription payments — improving the customer experience while also helping avoid write-offs and chargebacks.

Smart Subscriptions is available on our versionless API which makes it easy for issuers to bring subscription controls functionality to life in their banking channels.

Benefits for merchants

Reduce Friendly Fraud

Provide purchase clarity to remove upfront confusion — eliminating invalid disputes

Eliminate Revenue Loss

Eliminate unnecessary refunds and loss of revenue due to consumer purchase confusion

Reduce Chargeback Fees

Avoid unnecessary chargebacks from friendly fraud and customer disputes

Engage Consumers

Redirect disputes from issuer to merchant by providing clear merchant contact information

Benefits for issuers

Eliminate Confusion

Remove transaction confusion up front — eliminating friendly fraud disputes

Reduce Chargeback Costs

Avoid unnecessary chargebacks and write-offs from friendly fraud and customer disputes

Improve Experience

Improve customer experience and satisfaction

Resolve in One Call

Make dispute decisions correctly and quickly during initial call

The brink of transformation: What's next for digital banking?

Our latest research suggests we’re on the brink of major shifts in consumers’ attitudes, beliefs, and habits. These changes will propel the upcoming wave of digital banking innovations that will address unmet needs. The next iteration of tools and solutions must offer a compelling next-gen experience if businesses want to win new customers while also enhancing operations and driving better financial performance.